- Best Practices ●

- COVID-19 ●

- Industry Trends ●

- Partners ●

- Product ●

NFC vs. QR Code: Why QR Codes Are the Clear Winner

Cash isn’t king anymore. Your customers expect mobile-friendly options at checkout. Whether you run a restaurant or a retail store, supporting digital payments isn’t just convenient—it’s expected.

That’s why so many businesses are turning to tools like QR Codes and NFC. Both can enable quick, contactless transactions, but they work in very different ways. Depending on your setup, one might be far more flexible (and affordable) than the other.

Let’s break down the differences between QR Codes and NFC technology and explore why QR Codes come out ahead.

*Note: The brands and examples discussed below were found during our online research for this article.

Table of contents

NFC vs. QR Code

Before we dive into the differences between NFC technology and digital payment QR Codes, here’s a look at how the two compare at a glance.

| NFC | QR Code | |

| What is it? | Short-range wireless communication tech for data exchange | 2D barcode that stores data, readable by smartphones |

| How it works | Uses radio frequency to transmit data between two nearby devices or tags | Scanned by a smartphone camera to access encoded data or links |

| Top use cases | – Contactless payments – Bluetooth pairing – Access control (hotel keys, 24-hour gym entry) | – Product info and marketing – Digital menus and payments – Inventory tracking |

What is an NFC tag?

An NFC tag is a tiny wireless chip that communicates with nearby devices through near field communication (NFC) technology, which is a short-range wireless protocol that allows two devices to exchange information when they’re just a few centimeters apart.

Here’s how it works: A device (like a smartphone or card reader) generates a magnetic field that powers the NFC tag. Since the tag doesn’t have its own battery, it relies on this electromagnetic field to “wake up” and send back its stored data. This interaction happens at a frequency of 13.56 MHz and typically works within a 4-centimeter range.

NFC technology builds on older concepts like radio frequency identification (RFID). It first launched in smartphones in 2011 and quickly gained traction, particularly for mobile payments.

How is NFC used?

If you’ve ever tapped your credit card or smartphone to make a purchase, you’ve already used NFC technology. It powers most contactless payment systems and is built into mobile wallets like Apple Pay and Google Pay.

But payments aren’t the only use. NFC also works well for:

- Sharing a phone number.

- Sending photos or documents.

- Launching directions in Google Maps.

- Starting an app on another device.

- Connecting with nearby NFC tags.

From retail to personal productivity, NFC enables quick, short-range interactions without the need for Wi-Fi or a cellular connection.

Top use cases for NFC

NFC technology is widely used across industries thanks to its speed and simplicity. Some of the most common use cases include:

- Bluetooth pairing: Quickly connect headphones, speakers, and other devices.

- Digital business cards: Share contact info with a tap.

- Contactless payments: Tap credit cards or smartphones to pay at checkout.

- Access control systems: Unlock hotel rooms, open secure doors, or validate entry at events.

- Asset tracking: Monitor equipment and inventory in real time.

What is a QR Code?

A Quick Response (QR) Code is a type of two-dimensional barcode that can store much more information than a traditional barcode, powering everything from payments and marketing to healthcare and logistics.

When comparing QR Codes vs. barcodes, the differences are significant. Barcodes must be scanned from a specific angle using dedicated hardware. QR Codes, on the other hand, can be scanned from multiple angles using a smartphone camera app. They’re more versatile, more efficient, and much easier to use across different platforms.

QR Code readers are now built into nearly every smartphone, so users don’t need special apps or hardware. That accessibility makes QR Codes a natural fit for today’s mobile-first world.

Generating a QR Code is simple: just enter a URL, contact info, or other data into a QR Code generator. In seconds, you’ll have a scannable image you can print, share, or embed wherever it’s needed. When scanned, it takes users directly to your chosen destination, whether that’s a website, a landing page, or a payment portal.

How are QR Codes used?

QR Codes offer far more versatility than traditional barcodes or NFC, making them a go-to tool across industries. Here are some of the many ways people and businesses use them today:

- Make contactless and mobile payments during checkout

- Send Bitcoin and crypto payments

- Enable Wi-Fi access

- Share PDFs and document links

- Network with digital business cards

- Link to social media profiles

- Share video, image, and audio files

- Connect users to websites

- Register attendees for events or ticketing

- Collect feedback and survey responses

- Send SMS, emails, or plain text messages

- Deliver digital coupons

- Share directions via Google Maps

People can use QR Codes on print materials of all sizes and on digital marketing platforms to elevate the user experience.

Top use cases for QR Codes

Here are some of the most common places QR Codes are used to connect with customers and drive engagement:

- Bus stop and train station ads

- Business cards and digital profiles

- Customer surveys and feedback forms

- Coupons and discount offers

- Contest entries and giveaways

- Branded promotional items

Curious about how to create your own? Check out our step-by-step guide to creating a QR Code!

4 Disadvantages of NFC (and why QR Codes are better)

NFC technology can be helpful in certain retail environments, but it isn’t the right fit for every merchant—especially newer businesses or those in settings without a fixed payment terminal.

Here’s a look at four key limitations and why QR Codes are often the smarter, more flexible choice.

1. Limited mobile payments

To process payments via NFC, merchants need specialized hardware like point-of-sale (POS) terminals and contactless readers. That kind of hardware can be expensive—sometimes out of reach for small businesses or startups. There’s also a major accessibility gap. Only about 20% of the global population owns mobile devices with built-in NFC capability. So, even if you invest in the tech, there’s a good chance many of your customers won’t be able to use it.

You can use QR Codes for mobile payments without physical contact or needing a chip like NFC

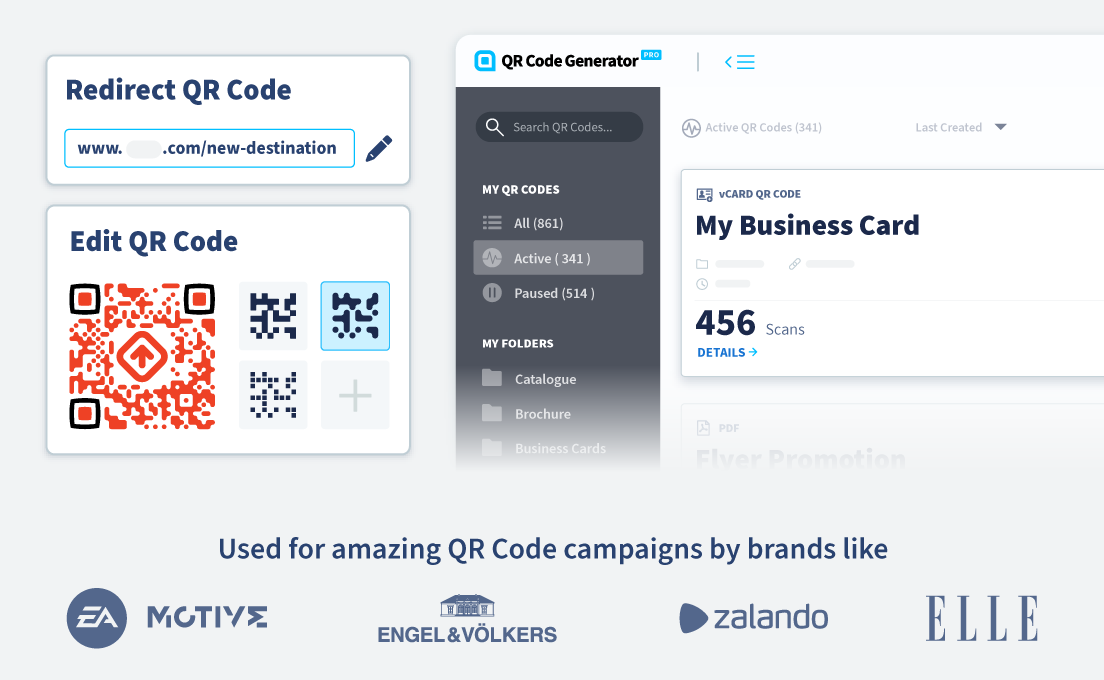

Why QR Code technology is better: QR Codes eliminate both hardware and accessibility barriers. With a tool like QR Code Generator PRO, you can create and share a code that takes customers straight to an online payment page with a single smartphone scan—no extra equipment required.

When customers scan, they can pay instantly using their preferred method, like Apple Pay or Google Pay. You can also generate platform-specific options, like an Apple Pay QR Code, a Venmo QR Code, or a Zelle QR Code, giving you full control over how you accept payments.

And since nearly every smartphone camera now recognizes QR Codes automatically, there’s no need for your customers to download anything. Just scan and pay.

2. Short distances only

NFC technology has a range of just a few centimeters. On top of that, NFC tags are placed in different spots on different phones, so both devices have to be aligned just right for the transfer to work. In busy retail and restaurant settings, needing that kind of close contact to process payments can slow things down, leading to longer lines, bottlenecks, and even missed sales.

QR Code technology is scannable from far away and doesn’t require physical contact

Why QR Code technology is better: QR Code tech is truly contactless and much more flexible. Because QR Codes can be scanned from a distance (even several feet away, depending on the size), customers can pay without needing to hand over their phone or hover over a terminal. That means faster checkout, less friction, and a smoother payment experience for everyone.

3. Device compatibility issues

NFC isn’t quite a universal technology. Payments can fail due to compatibility issues between devices, and operating system updates can sometimes interfere with NFC functionality.

NFC file transfers can be incompatible across different devices

Why QR Code technology is better: While NFC-enabled devices may struggle to communicate reliably across brands or platforms, QR Codes are truly universal. Almost all smartphones can scan QR Codes, and the process is the same every time: open your camera, point it at the code, and tap. Instead of compatibility concerns, you get simple, seamless access.

4. Major security flaws

One of the biggest downsides of NFC is the lack of robust security, which leaves the technology open to things like:

- Eavesdropping: Criminals can “listen in” on an NFC transmission to steal private information.

- Data corruption or manipulation: The data being transferred can be tampered with or corrupted, rendering it unusable.

- Interception attacks: Hackers can hijack the data transfer and redirect it to an unauthorized device.

NFC comes with serious security risks from criminals that manipulate and steal personal data

Why QR Code technology is better: QR Codes don’t carry the same security vulnerabilities as NFC. There’s no risk of eavesdropping, data tampering, or interception during the scan process.

And with a tool like QR Code Generator PRO, you’re also protected on the backend. The platform’s built-in URL shortener ensures that only you, the account owner, can change the destination link, reducing the risk of users being redirected to malicious content.

Create your first QR Code for free

If you want a faster, simpler, and more inclusive way to accept payments, QR Codes beat NFC on nearly every front. They’re more secure, more adaptable, and far easier to deploy, especially for small businesses or merchants without fixed terminals. And their use cases extend well beyond the point of sale, from marketing and inventory to customer engagement.

With QR Code Generator PRO, it’s easy to put QR Code payments into action. Create and customize payment QR Codes in minutes, tailor them to match your brand, and track their performance with built-in analytics. No extra hardware. No coding. No stress.

Start for free today and make your payment process more seamless, scalable, and customer-friendly.

Add custom colors, logos and frames.

Add custom colors, logos and frames.